The seeds of my dissent from economic orthodoxy were pretty much sown for me by my 1st professor on the 1st day of my 1st economics class.

This prof had gone to a great personal trouble to begin our exposure to the dismal science with a very down-to-earth and super-important lesson. She went so far as to spend her own cash on some things from the store, of varying cost, and gave us all at the beginning of the class random items. Some people got candy, some got socks, one or two got things of greater value.

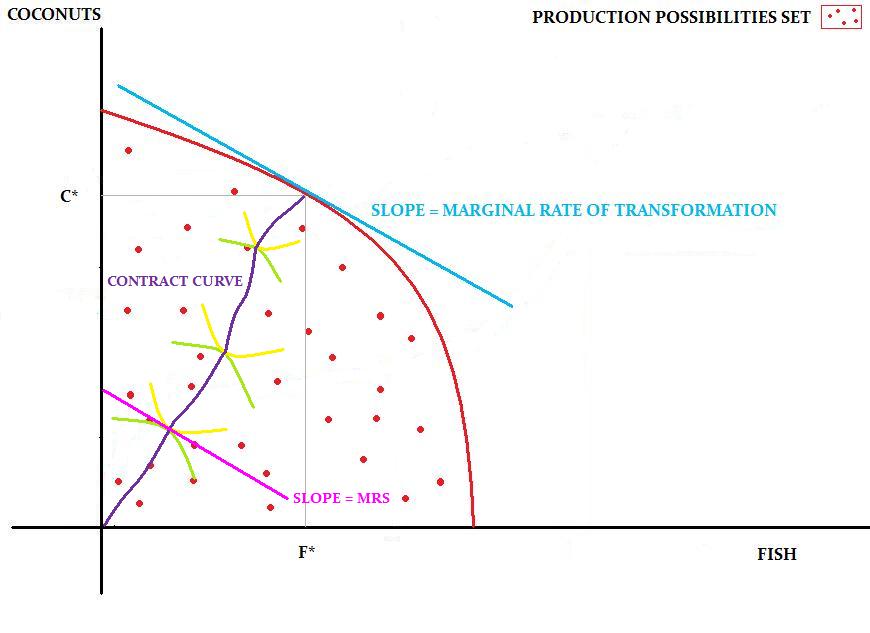

This was a masterful teaching stroke, by someone who cared deeply about her subject and teaching it to newbies: she would have us all participate in voluntary trade within the classroom and end up ≥ than we started. Gains from trade—the fundamental point about economics—are really “the only thing we know about welfare”. Sure, some people start off with more—more wealth, more smarts, better looks, genes that will make them grow taller so they can reach the mayonnaise jars from the back—but hey, at least we can make all of them better off and not hurt anyone by allowing them to trade freely.

Right?

We each reported, on a scale of 1 to 10, how satisfied we were with the Stuff we had been randomly given at the beginning of the class, and the prof wrote these scores down on the board. Then we were asked to stand up, walk about the room, and see if anyone would voluntarily exchange Stuff with us. Multiple transactions were allowed, even encouraged—and after a few minutes of cluelessly blitzing with each other, the trading day was closed and we resumed our seats.

The prof asked our scores again, fully expecting that ∀i in the class, utility before ≥ utility after.

But one girl reported a lower score.

Instead of taking this as evidence against her belief that transactions are always mutually beneficial—a cornerstone of normative economic theory—the prof instead scolded the girl. “Well, what’d ya do that for?!”

By the way, this was not a prof who prepended test questions with the phrase “According to the theory we learned in class,” which means I still dispute that I got that one about the lobstermongers right! (Since it asked about “What would happen” not “what the theory says would happen”.)

At the time I thought the outburst a bit rude and over the years to come I remembered the episode. (well, obviously) I still think of it as a microcosm of certain intellectual misdeeds by economists. The framework is too important to hold onto; if anyone undermines then you get angry and yell at them! It’s a plausibility war, after all.

Not too far off from real comments by economists: But if you took away the mutually-beneficial assumption, then you’d have no theory at all! (Regardless of whether nullset is the only true theory we have.)

The assumptions about what goes on in transactions are so appealing that even when you see them violated in front of your eyes, they’re still so implausible and—hey—what about all this stuff I learned about indifference curves? If I saw so many graphs with them not overlapping or going backwards, then that has to be the truth, because maths!

Nevermind that people don’t always know what they want, or maybe it’s contradictory or impossible, and even in well-defined classroom experiments they may just, um, do it wrong.

Happy Independence Day. Here’s to hoping you don’t use the independence to shoot yourself in the foot.